cumulative preferred stock formula

For example assume the company has issued 50000 shares at par value of. Steady growth rate example.

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

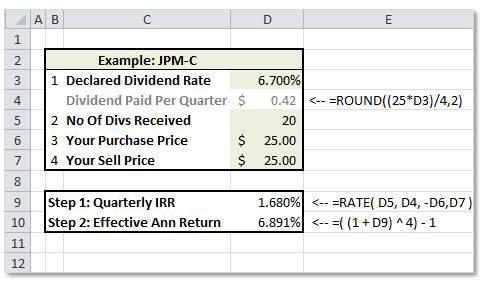

The companys current quarterly dividend distribution is 025 which corresponds to an expected total annual dividend payout of 100 for the upcoming 12-month.

. For one thing companies get a tax write-off on the dividend income of preferred stocks. To better illustrate the formula and its application here is an example. Can be converted into common stock cumulative paid-in-kind.

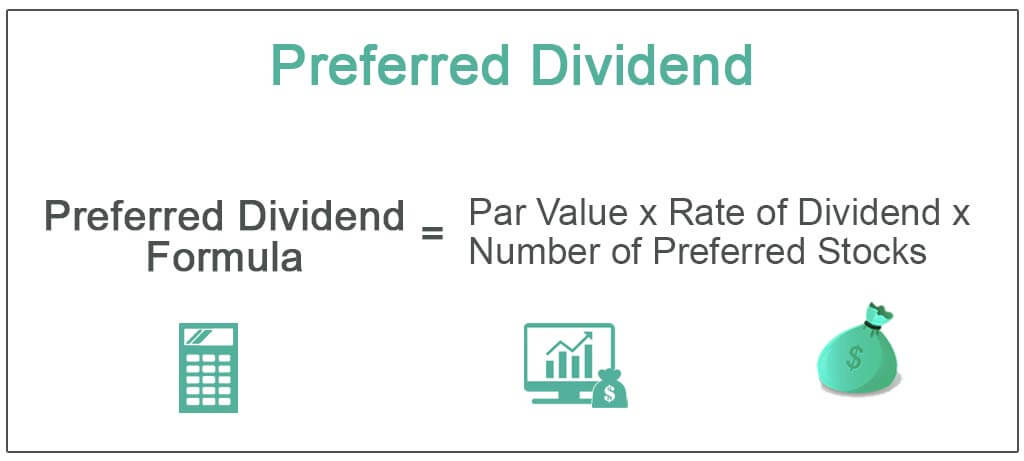

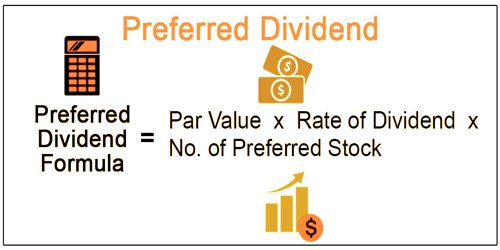

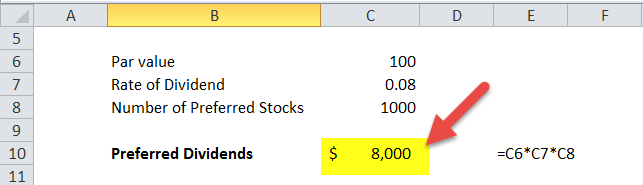

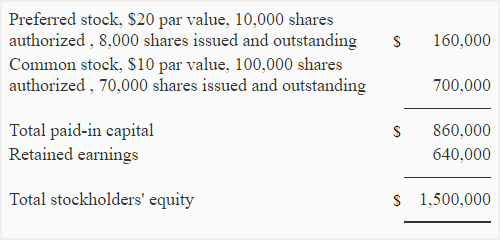

Not insured by FDICNCUSIF or any federal. Number of shares issued X par value paid in capital number of shares issued. Preferred Dividend formula Par value Rate of Dividend Number of Preferred Stocks 100 008 1000 8000.

Preferred stock have a coupon rate -- the interest rate you will. Preferred stock is a hybrid form of equity characterized by features of both common shares and debt. Which represents the excess value above the par value can be calculated using the formula below.

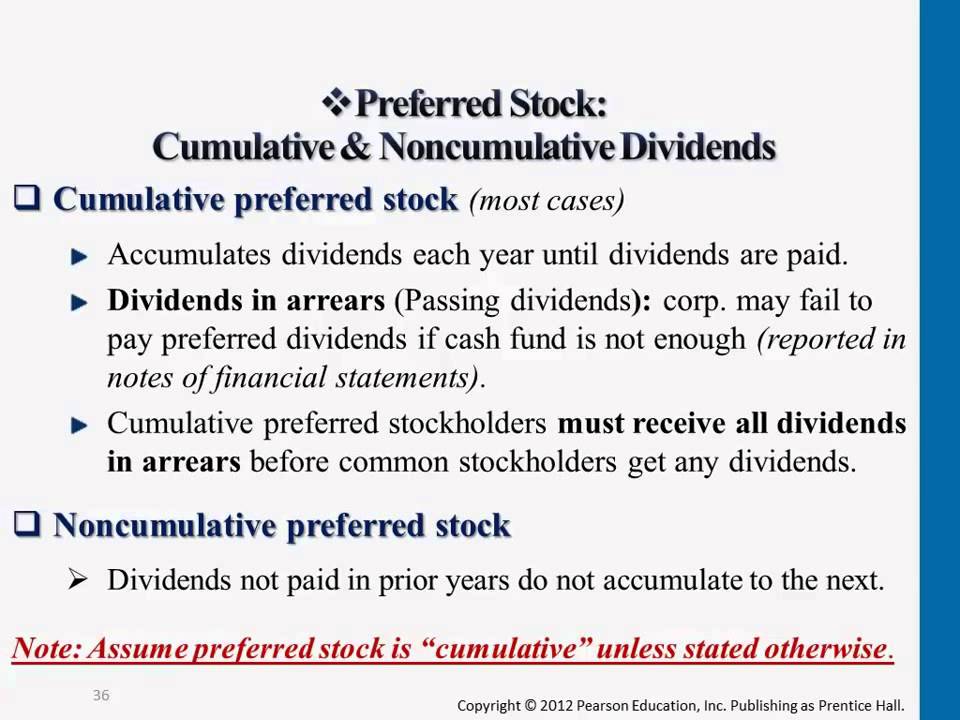

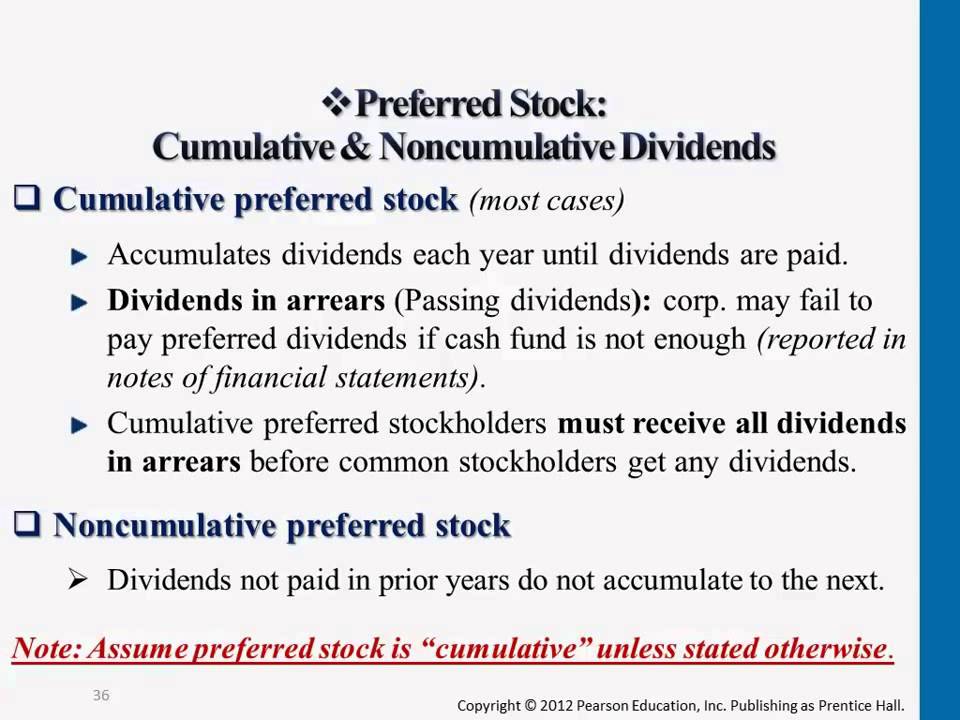

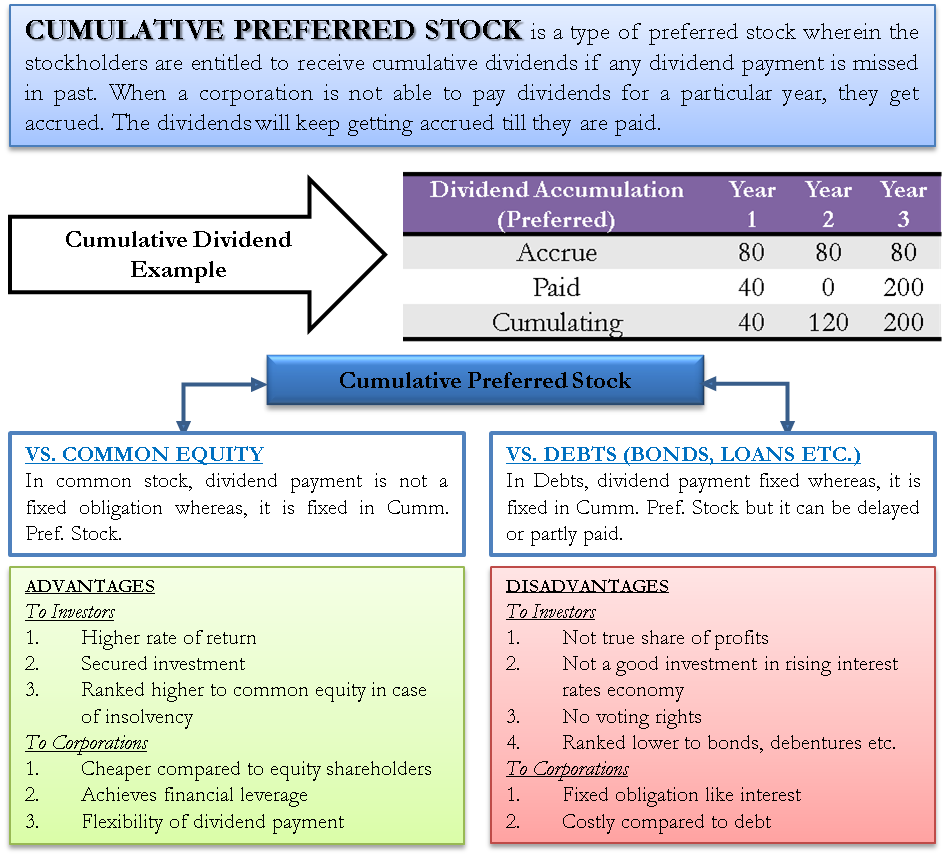

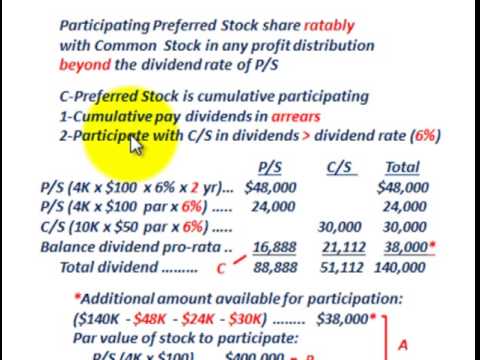

These issues have floating rates from the day they are issued and always contain a floating rate formula with an overriding minimum coupon usually 3-45. Dividends are either cumulativeCumulative means that dividends continue to accrue if they have been suspended. For instance preferred stock can come with call options conversion features ie.

Cumulative preferred stocks may postpone the dividend but not skip it entirely the company. Pnet net issuing price. A firm can issue preferred stock to raise money.

Companies also use preferred stocks to transfer corporate ownership to another company. Lets say a companys preferred stock pays a dividend of. 449 816 net price is 49 Cost of retained earnings.

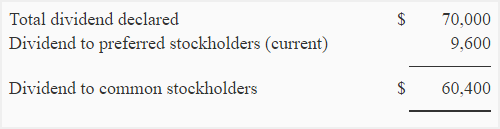

Made up of accumulated parts. What is the cost of preferred stock. Dividends in arrears are not relevant when calculating EPS.

5500 on the current interest rate and then compare it with Rs. Therefore we enter our numbers into the simple cost of preferred stock formula to get the following. The rate at which the dividend will be paid out it is.

Preferred dividends would be added back to reflect the conversion of convertible preferred stock and any. Retained earnings are the cumulative amount of net earnings since the company was formed minus any dividends issued to shareholders. For example if a company owns 20 or more of another distributing companys stock they dont have to pay taxes on the first 65 of income received from dividends.

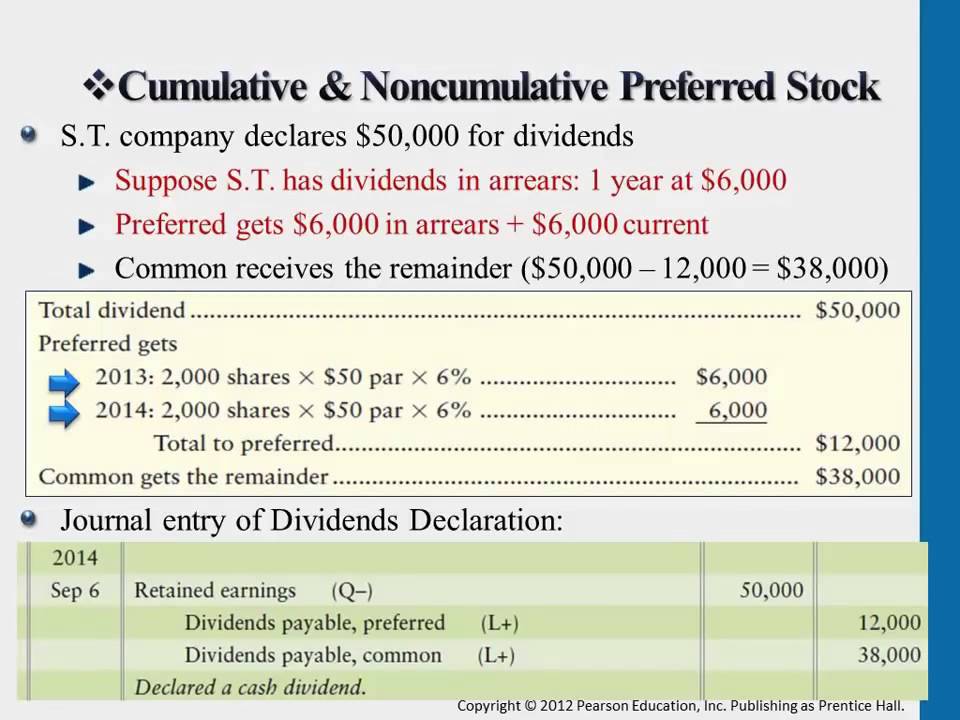

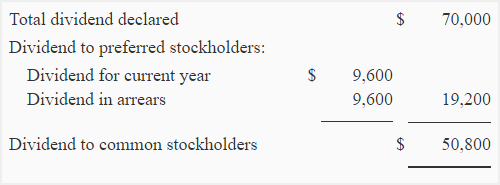

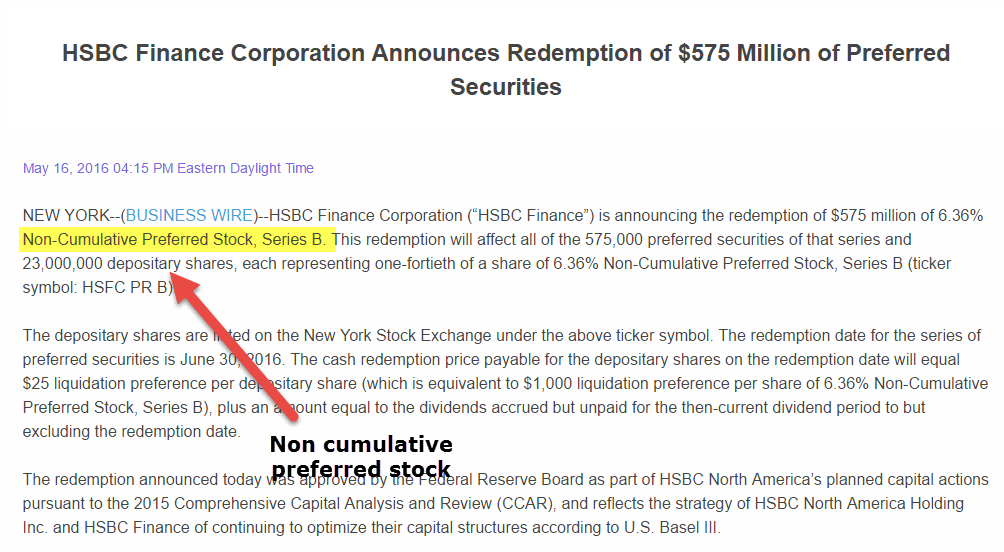

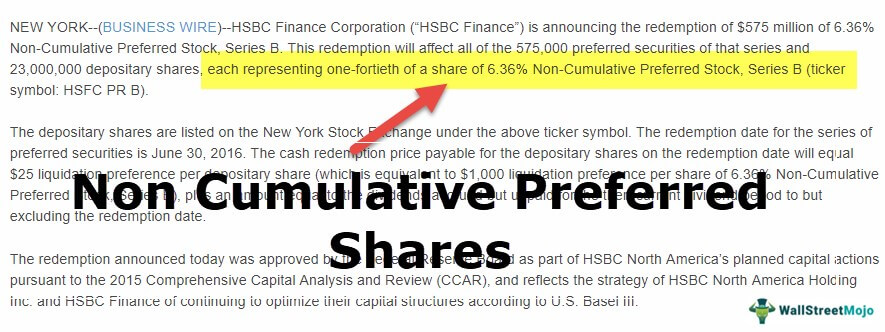

Preferred Stock Index measures performance of the US. This feature of arrear payment is only available with the cumulative preferred stock The Cumulative Preferred Stock Cumulative preferred stock is a class of shares wherein any current years unpaid or undeclared dividends. Cumulative preferred stock refers to shares that have a provision stating that if any dividends have been missed in the past they must be paid out to preferred shareholders first.

The face value of a bond or any fixed-income instrumentPar value is also known as Face Value or Nominal Value. The number of shares the preference shareholder is holdingPreference shareholders are entitled to get fixed dividends on a regular interval. Whether Company Z should take Rs.

This formula calculates the average issue price per share of preferred stock. The SP US. Dps preferred dividends.

30-day SEC Yield is a standardized yield calculated according to a formula set by the SEC and is subject to change. 5000 today or Rs. Preferred stock is a hybrid security that integrates features of both common stocks and bonds.

Adjective increasing by successive additions. 5000 if the present value of Rs. When preferred shares are cumulative jargon explanation needed annual dividends are deducted whether or not they have been declared.

Now in order to understand which of either deal is better ie. 5000 then it is better for Company Z to take money after two years otherwise take Rs. Let us assume that ABC Corporations stock currently trades at 10 per share.

5500 is higher than Rs. The firm will pay 400 dividend every year to preferred stock holders. Perpetual and cumulative preferred stock Cumulative Preferred Stock Cumulative preferred stock is a class of shares wherein any current years unpaid or undeclared dividends must be accumulated and paid in the future.

Rps cost of preferred stock. Where Number of preferred stocks. The formula for calculation of dividend yield ratio is Dividend per Share Market Price per Share 100.

The market price for one share of the firms preferred stock is 50 but flotation cost is 2 or 1 per share. Cost of Preferred Stock. Returns for periods of less than one year are cumulative total returns.

Basic formula Earnings per share. 5500 after two years we need to calculate a present value of Rs.

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Dividend Definition Formula How To Calculate

Preferred Stock Cumulative Noncumulative Dividends Youtube

Non Cumulative Preference Shares Advantages And Disadvantages

Preferred Shares Meaning Examples Top 6 Types

Preferred Dividend Assignment Point

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

How To Calculate Cumulative Dividends Per Share The Motley Fool

Non Cumulative Preference Shares Stock Top Examples Advantages

Cumulative Preferred Stock Define Example Benefits Disadvantages

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Stock Non Cumulative Partially Participating Allocating Dividends To P S C S Youtube

Preferred Dividend Definition Formula How To Calculate

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Preferred Shares Meaning Examples Top 6 Types

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management